Indian Express Editorial Analysis

15 May 2020

1) Falling short-

CONTEXT:

On Thursday, Finance Minister Nirmala Sitharaman unveiled(open up) the second tranche(a part of total money) of relief measures to alleviate(reduce) the stress stemming(coming in) from the coronavirus.

While the first set of measures was geared(aimed) towards ensuring liquidity(money) flow to various parts of the economy, the second aims to ensure food security for migrants workers, and ease credit flows to the more vulnerable sections of society — street vendors and small farmers, among others.

But though more announcements are in the offing(likely to happen soon), for a country which has gone through the most stringent(strict) of lockdowns, with the thinnest of safety nets, the measures so far lack the required breadth and depth.

MEASURES:

To ensure food security for migrants, the government has announced two sets of measures.

First, provision of foodgrains for the next two months — this includes the non-ration card-holders who are not covered by the national food security act or state schemes.

And second, portability of benefits. This implies that ration card-holders will now be able to withdraw rations from anywhere in the country, not just their home states.

While both these relief measures are welcome, they have come too late in the day. By the government’s own admission, this measure will cover 8 crore migrants. This is a staggering(deeply shocking) number.

Implementing these measures early on could have averted(prevented) the painful migrant crisis that has unfolded over the past several weeks. Ensuring food security, some form of short-term income support to tide over(overcome) this crisis, could have alleviated(reduced) their hardship.

PROBLEMS OF IDENTIFICATION:

Further, if the only plan for migrant workers is to provide them jobs under MGNREGA, then surely the first step should be to significantly ramp up(increase) allocations to the scheme. The efficacy(effectiveness) of measures geared towards ensuring easier access to cheaper credit is also questionable.

For instance, a special credit facility has been set up for over 50 lakh street vendors with an estimated outlay of Rs 5,000 crore.

But in a country with well-known problems of identification of beneficiaries for government schemes, that may not be enough. The credit linked subsidy scheme for affordable housing has been extended by another year — but with questions over job/income security, its ability to spur(push) demand for affordable housing is questionable. There are also contradictory(opposite) signal over labour laws.

Sitharaman spoke of extending minimum wages, and providing protection to workers, yet at the same time, the Uttar Pradesh government, ruled by the BJP, is in favour of doing away with all forms of labour protection.

(Pradhan Mantri Awas Yojana believes that the Government of India's implementation of various policies and initiatives, in order to encourage availability of credit to the affordable housing industry, has provided significant growth opportunities in the housing finance industry. ABHFL aims to continue to provide financing for such housing projects and further expand its housing finance business by increasing the geographic reach in tier 2/3 cities)

CONCLUSION:

The hurt borne(faced) by the most vulnerable in this crisis is likely to be far greater than the relief measures the government has announced so far can address. Though the government has said that measures are still in the offing, the scale of that distress requires it to do more.

2) In EC’s court-

CONTEXT:

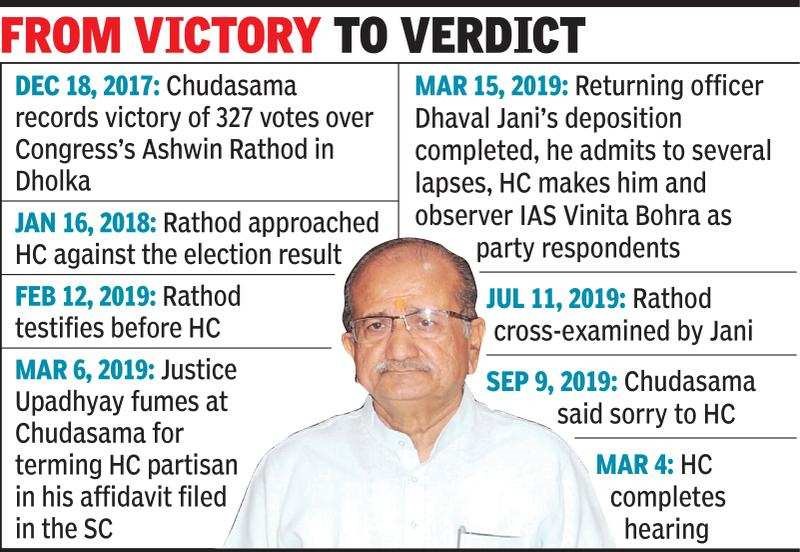

Amid the pandemic, a court verdict(decision) has delivered a setback(shock) of a different kind to the Gujarat government, and to the Election Commission of India. In a rare step on Tuesday, the Gujarat High Court set aside the election in 2017 of Bhupendrasinh Chudasama, minister with multiple portfolios in the Vijay Rupani government, from Dholka constituency, and upheld the contention of the petitioner, his Congress rival(opponent) in that election, that it was conducted in violation of the poll code.

The court ruling was strikingly stern(strict) and strong: It spoke of 429 “illegally” rejected and excluded postal ballots when the margin of victory was a slender(slight) 327, of an “unholy nexus”, “manipulation of record”, and “corrupt practice”, which gave an unfair advantage to the winning candidate and materially affected the result.

The High Court verdict is set to be challenged in the Supreme Court, but it lends weight to allegations of misuse of government machinery to influence an election. And it places in the dock the Returning Officer, Dholka’s deputy collector, Dhaval Jani. In the verdict’s aftermath, the EC has constituted a three-member Committee of Officers and has spoken of disciplinary proceedings against the RO being underway(having started and in progress). But that, surely, cannot be the end of the embarrassment.

INDEPENDENT AND IMPARTIAL MONITOR:

The Election Commission is deservedly feted(honoured) as the independent and impartial monitor of a poll process of staggering(deeply shocking) complexity in a large and diverse country. Over the years, it has earned its place at the top of the heap of India’s most trusted institutions.

Yet, it is also true that its stature and standing calls for constant vigilance(examination) by the poll monitor against every and any breach of due poll process. That an election has been held invalid by the court is an indictment(accusation) that needs to be addressed seriously, and institutionally.

This is especially important in times when politics is becoming more confrontational, and when the EC is coming under increasing fire(criticism) for feeble(weak) interventions that are heard less and less.

EC’s REBUKE:

The EC’s rebuke and reprimand(express sharp disapproval or criticism) even for violations of the legally un-enforceable Model Code of Conduct matter because of its formidable reputation for fairness. Any signs of institutional weakening or sloth(laziness) — in the recent Uddhav Thackeray election case, it reportedly took a call from the chief minister to the prime minister and then the governor’s intervention to prod(push) the EC to hold an election that was necessary to avert(avoid) a political crisis — must be guarded against.

CONCLUSION:

The EC must act, and be seen to act, to ensure that the aberration in Gujarat remains just that. Setting aside of election in Gujarat by court poses a question it must respond to seriously and institutionally.

3) Credit lifeline-

CONTEXT:

The battle against the virus is likely to last several more months, implying prolonged(longing) curtailment(restriction) of economic activity to ensure social distancing. The resultant economic pain has been, and is likely to be, broad-based, though it is most acutely(severely) felt by the indigent(poor) and small-scale enterprises.

Not only is it necessary to support the worst-affected, but it is also necessary to preserve India’s economic growth potential, so that, once the restrictions are lifted, the economy quickly reverts(gets back) to a rapid growth trajectory.

The first package (‘How to minimise the damage’, IE, March 28) announced by the Union government focused on the poor, and the second rightly focuses on providing credit(money) to smaller enterprises(business).

ASSESSING POLICY MEASURES:

While assessing policy measures during the lockdown, where stimulating(encouraging) new activity has limited value, we believe there are two over-arching(comprehensive) principles one must keep in mind.

One, the flow of funds slows with economic activity; and two, firms do not go bankrupt(unable to pay their debts) because of insolvency, but because of lack of access to funds (also called liquidity).

Policymakers over the world are pulling out all stops to make sure that the flow of credit continues. Of the Rs 20-lakh-crore economic support announced by the Prime Minister on May 12, we have details for about Rs 16 lakh crore.

Monetary and financial interventions taken by the government and the RBI to provide credit to those who need it make up more than 90 per cent of it.

Most of the measures announced by the RBI earlier have not had the desired effect, with the quantum of cheap funds being made available being more or less the same as the increase in the amount being deposited in the RBI every night by banks. Heightened risk aversion(avoidance) in banks has meant that just reducing the cost of funds had no impact on the volume and cost of the credit they provided. At this stage of the cycle, this is not surprising.

CREDIT SUPPORT TO THE MSMEs:

The series of measures announced to provide credit support to the micro, small and medium enterprises (MSMEs) attempts to address this gap. We believe the largest of these schemes is likely to be the most effective, particularly as it comes without too many conditions.

For standard MSMEs (that is, those that have been servicing their loans so far), new loans up to 20 per cent of the current outstanding credit will be fully backstopped(supported) by the government. That is, if there is a default, the government will pay the bank.

We expect this to drive immediate credit creation, as guarantees are available only for loans extended in the next six months, lenders have zero risk, and the borrowers are most likely stressed and would want these funds.

It is possible if not likely that firms will use these loans to just pay interest and cover losses, but if so, that in a way is the purpose of this scheme — the government absorbing losses upfront rather than the (likely larger) lost taxes and potential bank bailouts(an act of giving financial assistance to a failing business or economy to save it from collapse) if there is a bankruptcy.

For the government, the costs of this guarantee would be spread over several years, with at most 10 per cent incurred in this fiscal year.

LIQUIDITY TO NBFCs:

The two schemes together, targeting to provide Rs 75,000 crore of liquidity to non-banking finance companies (NBFCs), may be a bit less successful, however, in our view. The special purpose vehicle that is to provide liquidity to NBFCs provides funds for three months at a time, may be enough to prevent accidents (like an NBFC defaulting due to lack of liquidity).

But it may not suffice(sufficient) to get them to grow. The partial credit guarantee given to banks’ loans to NBFCs may be more effective for a subset(a part of a larger group of related things) of NBFCs, but as it is only available to public sector banks, it would depend on their willingness and ability to extend new loans.

EQUITY FOR MSMEs:

The Rs 50,000 crore fund to provide equity for MSMEs, with a corpus of Rs 10,000 crore being provided by the government, which would then be leveraged(use (something) to maximum advantage), is an interesting initiative. Losses incurred in the current lockdown are depleting(reducing) risk capital, something that the country was short of even before this crisis.

Replenishing(filling in) if not growing that is paramount(most important) to restoring India’s growth potential. While global as well as local private equity and venture capital funds would continue to explore and invest in smaller firms, such a fund can scale up the funds availability significantly.

Its efficacy though can be judged only after details emerge on the nature of the fund (like its duration, the investors it raises funds from), as well as how it would operate. A sharp increase in credit to farmers, through Kisan Credit Cards (extended to livestock farmers and fishermen) as well as special loans, should also help funds flow in the economy by increasing the quantum of new bank credit.

LIMITATION:

The natural limitation of the policy interventions thus far is that they only affect enterprises in the formal sector and in agriculture. As we are talking about taxpayer funds and formal savings, it may be unfair to allocate them to informal enterprises. Such measures (or say if the government provides GST credits for liquidity support) may be incentives for firms to formalise, but the pain in informal non-agricultural enterprises may stay unaddressed, and remain an overhang(a part of something that extends or hangs over something else) on growth.

While less than 10 per cent of the announcements thus far has been the fiscal cost, the remaining 4 lakh crores of the economic package may have a greater fiscal element, though at this stage it appears unlikely. One senses a fiscal caution in government measures that in our view is overdone, and could hurt more than it helps.

By pre-announcing the additional bond issuance for the year, and giving an implicit(suggested though not directly expressed) assurance that additional deficits would be financed separately, bond market volatility has been minimised. Even though that potentially means the RBI purchasing government bonds, the rupee has been remarkably stable — there was fear that fiscal spending financed by the central bank would be frowned upon and drive currency weakness.

CONCLUSION:

The road ahead remains unclear, but it is likely that the economic damage is already much larger than the measures undertaken so far. It is best to see this as the beginning of government action.

The scale of government intervention may have to intensify(increase) in the coming months. We believe a continued focus on reforms and on sustaining India’s growth potential will be critical in preventing macroeconomic(relating to the branch of economics concerned with large-scale or general economic factors, such as interest rates and national productivity) instability.